When you evaluate Arizona stone brands reputation, you’re navigating a market where performance claims often outpace field results. You need to understand how major distributors stack up against actual installation outcomes before you commit project budgets. The gap between marketing promises and real-world durability becomes obvious within 18-24 months of installation—long after warranty claims become complicated.

Your specification decisions require more than glossy brochures and sales presentations. You should examine tile stone brands Arizona reviews from contractors who’ve returned to projects years later, not just initial installation photos. Professional reputation in this market reflects consistent material quality, accurate lead time projections, and how distributors handle inevitable product issues.

Here’s what separates reliable suppliers from problematic ones: response time when you discover dimensional tolerance problems mid-installation, warehouse stock accuracy when your schedule depends on material availability, and technical support depth when field conditions don’t match specification assumptions. Arizona stone brands reputation reveals itself through these pressure points more than through curated testimonials.

Arizona Stone Brand Landscape

The Arizona market concentrates around three major distribution models, each with distinct advantages and limitations you need to understand. National chains offer broad inventory depth but often struggle with regional expertise specific to desert climate challenges. Local distributors provide responsive service but may lack buying power for competitive pricing on premium materials.

When you research stone brands Arizona ratings, you’ll find that size doesn’t always correlate with reliability. Mid-sized regional players often outperform national operations in technical support quality and custom order accuracy. Your project success depends less on brand recognition than on understanding each distributor’s actual capabilities in your specific material category.

- You should verify whether distributors maintain local warehouse inventory or drop-ship from distant facilities—this affects your lead time accuracy by 40-60%

- Regional climate expertise matters more than national market share when you’re specifying materials for 115°F summer installations

- Technical support quality varies dramatically between distributor locations even within the same corporate structure

- Custom fabrication capabilities differ significantly—some locations outsource while others maintain in-house equipment

Arizona Tile Performance Analysis

Arizona Tile operates as one of the state’s largest distributors, and tile stone brands Arizona reviews for this operation reveal a mixed performance picture. You’ll find their inventory breadth impressive for standard residential applications, but custom commercial work often exposes limitations in technical consultation depth. Their showroom presentation exceeds most competitors, yet field support consistency varies significantly between valley locations.

When you evaluate their reputation among commercial specifiers, dimensional tolerance control emerges as a recurring concern. Projects requiring tight +/- specifications report higher rejection rates than comparable orders through specialty fabricators. Your quality control protocols need to account for this if you’re specifying Arizona Tile for precision installations.

Lead time accuracy presents another variable in stone brands Arizona ratings for this distributor. Stock items typically ship as promised, but special orders frequently encounter 2-3 week delays beyond quoted timelines. You should build buffer time into your schedule if your project depends on non-stock materials from their network.

Bedrosian Reputation Factors

Bedrosian’s market position centers on design-forward materials and trend-responsive inventory. When you examine Arizona Tile Bedrosian MSI reviews comparatively, Bedrosian consistently scores higher for aesthetic range but lower for technical support depth. Their sales team excels at visual presentation but often defers complex installation questions to outside resources.

You’ll find their pricing structure positioned at premium levels, and Arizona stone brands reputation discussions frequently question whether the cost differential delivers proportional value. For high-visibility residential work where design distinctiveness justifies budget, Bedrosian provides options unavailable through commodity distributors. Commercial work with performance-driven specifications may find better value elsewhere.

- Your specification process should account for their limited custom fabrication capabilities—most modifications require third-party processing

- Bedrosian maintains smaller local inventory than competitors, increasing dependence on warehouse transfers

- Designer services add value for residential clients but don’t typically address commercial performance requirements

- Return policies prove more restrictive than industry standard, affecting your risk on color-match sensitive projects

MSI Market Position

MSI operates through a high-volume distribution model that prioritizes inventory turnover over specialized service. When you analyze stone brand testimonials Arizona sources, MSI generates polarized feedback—contractors appreciate aggressive pricing, while architects often cite frustrations with technical support limitations. Your project type determines whether their model serves your needs effectively.

Their warehouse network provides genuine advantages for stock material availability. You can often source common specifications with 48-72 hour lead times that competing distributors can’t match. This reliability matters significantly when you’re managing fast-track schedules or coordinating multiple trade sequences with tight material dependencies.

Quality consistency represents MSI’s most significant reputation challenge in tile stone brands Arizona reviews. Batch-to-batch variation exceeds tolerance expectations for commercial work requiring visual uniformity across large installations. You need robust sample approval processes and should anticipate 8-12% overage requirements to accommodate sorting and rejection rates.

Specialty Distributor Comparison

Beyond the major chains, Arizona’s specialty stone distributors often deliver superior outcomes for specific material categories. When you need natural stone with tight geological selection criteria, smaller operations frequently provide better quality control than high-volume warehouses. Their buyer relationships allow for source-specific procurement that commodity distributors can’t economically justify.

You’ll discover that Arizona stone brands reputation among experienced fabricators favors these specialty players for complex projects. They understand the difference between theoretical specifications and field-achievable results, saving you from expensive mid-project adjustments. Their technical consultation addresses installation methodology, not just product features.

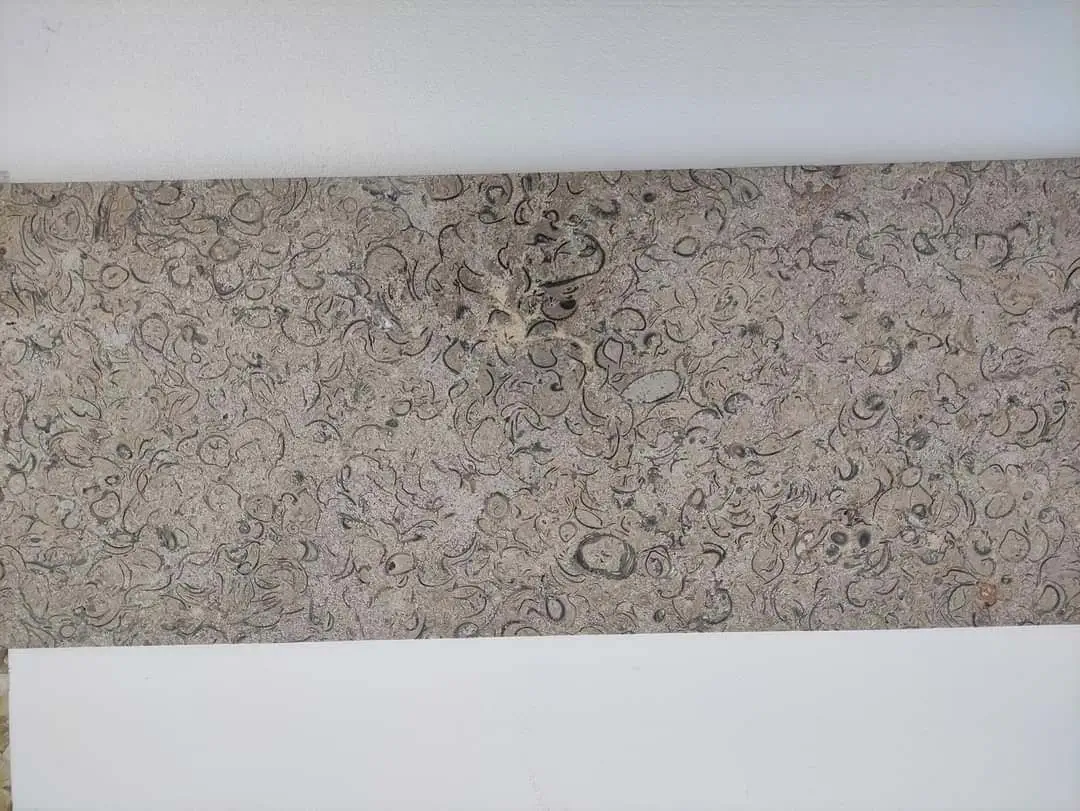

For projects demanding exceptional Arizona stone supply inc materials, working with dedicated slab yards offers significant advantages. Visiting Citadel Stone’s granite slab yard demonstrates how specialized operations maintain quality standards impossible in high-turnover warehouse environments. You gain direct material selection control rather than relying on remote warehouse stock.

Review Verification Challenges

When you examine stone brands Arizona ratings online, you’re encountering a verification problem that distorts reputation assessment. Distributors actively solicit reviews from satisfied residential customers while commercial contractors rarely document routine successful projects. This creates sampling bias that overrepresents simple installations and underrepresents complex commercial work.

You should approach stone brand testimonials Arizona platforms with professional skepticism. Generic praise about “beautiful stone” or “great service” provides minimal useful data compared to specific feedback addressing dimensional accuracy, color consistency across shipments, or technical support quality during installation problems. Look for reviews that demonstrate actual material knowledge and project complexity.

- Third-party review platforms can’t effectively verify reviewer credentials or project scope

- You’ll find that timing matters—reviews posted within 30 days reflect sales experience, not long-term material performance

- Rating inflation occurs systematically across the industry, making 4.5+ scores nearly meaningless without context

- Negative reviews often reflect customer expectation mismatches rather than actual distributor failures

Performance Versus Marketing Analysis

The disconnect between Arizona stone brands reputation marketing and actual field performance centers on how distributors define “quality.” Sales presentations emphasize aesthetic appeal and initial cost, while your project success depends on dimensional consistency, absorption rates, and long-term weathering characteristics. These technical factors rarely appear in promotional materials but determine installation outcomes.

When you evaluate tile stone brands Arizona reviews against technical specifications, you’ll discover most feedback addresses customer service and pricing rather than material performance data. This reflects the reality that most reviewers lack technical expertise to assess critical factors like compressive strength consistency, thermal expansion coefficients, or porosity variation within shipments.

Professional specification requires you to move beyond reputation scores to verify actual material testing protocols. Ask distributors about their incoming QC processes—many perform zero independent verification, simply accepting supplier certifications. You’re assuming significant risk if you rely on brand reputation without confirming batch-specific test data for your project’s material.

Regional Climate Considerations

Arizona’s extreme thermal cycling creates performance challenges that separate quality distributors from problematic ones. Stone brands Arizona ratings should reflect how well suppliers understand desert-specific installation requirements, but most reviews ignore climate factors entirely. You need to assess whether distributors provide guidance on thermal expansion accommodation, UV degradation resistance, and efflorescence prevention specific to Southwest conditions.

Materials that perform excellently in moderate climates often fail within 3-5 years in Arizona’s environment. Your distributor’s regional experience determines whether they’ll steer you away from inappropriate specifications before problems emerge. Generic product knowledge doesn’t substitute for understanding how 140°F surface temperatures affect specific stone types.

When you examine Arizona Tile Bedrosian MSI reviews for climate-appropriate recommendations, you’ll find significant gaps. Most distributors default to manufacturer guidelines developed for national markets rather than providing Arizona-specific installation protocols. This knowledge deficit costs you in premature failures and warranty disputes that damage your professional reputation.

Fabrication Capability Assessment

In-house fabrication capacity dramatically affects Arizona stone brands reputation among professionals managing complex projects. Distributors who maintain CNC equipment and experienced fabricators deliver tighter tolerances and faster turnaround than operations relying on subcontracted processing. You’ll experience fewer installation delays and quality issues when fabrication occurs under direct distributor control.

When you evaluate stone brand testimonials Arizona contractors provide, fabrication quality emerges as a critical differentiator. Edge profile consistency, cutout accuracy, and surface finish quality vary substantially between distributors. Your field crews lose productivity sorting through poorly fabricated pieces or correcting dimensional errors that should have been caught during QC.

- You should verify actual equipment capabilities, not just claimed services—many distributors outsource complex cuts

- Turnaround time commitments mean nothing without understanding shop capacity during peak seasons

- Template accuracy determines installation efficiency more than material quality in many applications

- Fabrication errors typically become apparent only during installation, creating expensive project delays

Warranty and Support Reality

Tile stone brands Arizona reviews rarely address warranty claim experiences because problems emerge 18-36 months post-installation, long after customers post initial feedback. You need to understand that warranty terms appearing generous in sales agreements often prove restrictive when you’re documenting claims for material defects versus installation issues. Burden of proof requirements effectively void many theoretical warranty protections.

Your practical warranty evaluation should focus on distributor responsiveness during the claim investigation phase. Arizona stone brands reputation suffers most when suppliers become difficult to reach after problems surface. The difference between a 10-day claim response and a 90-day delay determines whether warranty coverage provides real protection or just marketing value.

Technical support quality matters more than warranty duration for most commercial applications. When you encounter field issues requiring expert consultation, distributor response time and expertise depth directly impact your project costs. Stone brands Arizona ratings should reflect this support quality, but review platforms don’t capture these professional service dimensions effectively.

Pricing Transparency Issues

One factor notably absent from most Arizona stone brands reputation discussions involves pricing consistency and transparency. You’ll discover that quoted prices often transform during order processing as distributors add freight adjustments, special handling charges, and “unforeseen” fees not disclosed during initial discussions. This pricing volatility complicates your budget management and erodes trust in distributor relationships.

When you compare Arizona Tile Bedrosian MSI reviews on pricing, recognize that residential customers typically receive different rate structures than commercial contractors. Your buying power and order frequency affect pricing more than published rate sheets suggest. Establishing clear pricing agreements with detailed fee disclosures protects you from budget surprises during project execution.

Volume discount thresholds vary dramatically between distributors and often require negotiation rather than following standard schedules. You should verify break points and qualification criteria before committing to large orders, as assumed savings may not materialize if order structures don’t align with distributor policies. Pricing reputation proves difficult to assess from third-party reviews because most customers lack comparison data.

Citadel Stone Arizona Stone Supply Inc Approach

When you consider Arizona stone brands reputation from a specification rather than retail perspective, Citadel Stone’s Arizona stone supply inc operations demonstrate how specialized distributors serve professional markets differently than commodity warehouses. At Citadel Stone, we focus on technical consultation that addresses field installation realities rather than showroom aesthetics. This section outlines how you would approach material selection for six representative Arizona cities using our advisory framework.

Arizona’s climate zones create distinct performance requirements you need to address through city-specific specifications. The following subsections provide hypothetical guidance on how you would adapt material selection and installation protocols to regional conditions. These recommendations reflect technical considerations rather than completed project documentation.

Phoenix Specifications

In Phoenix, you would need to account for extreme thermal cycling between 115°F peak surface temperatures and overnight lows. Your specifications should address thermal expansion coefficients of 5.3 × 10⁻⁶ per °F minimum, requiring expansion joint spacing at 12-15 foot intervals. Material porosity should remain below 6% to prevent moisture-related degradation during monsoon season following extended heat exposure. You’d specify light-colored stones with solar reflectance values exceeding 0.60 to moderate surface temperatures in pedestrian applications. Base preparation would require 8-inch aggregate depth minimum with proper drainage to accommodate soil expansion in clay-heavy valley substrates.

Tucson Considerations

Your Tucson specifications would address similar heat factors as Phoenix but with greater elevation variation affecting frost considerations. You’d need to verify freeze-thaw durability for projects above 3,000 feet where winter temperatures occasionally drop below 25°F. Material selection should emphasize stones with absorption rates below 3.5% and verified ASTM C1026 compliance. The caliche-heavy soils in this region require you to specify enhanced base preparation with geotextile separation layers. You would recommend honed finishes over polished surfaces to maintain slip resistance as monsoon dust creates surface film that becomes hazardous when wet.

Scottsdale Standards

Scottsdale applications typically involve high-end residential and resort specifications where you’d balance performance requirements with aesthetic expectations. Your material selections would emphasize premium grades with tight color consistency across shipment batches. Installation protocols should address irrigation overspray exposure common in luxury landscape applications, requiring enhanced sealing specifications and edge detail protection. You’d specify materials with demonstrated resistance to hard water deposits and chemical pool treatments. Premium fabrication tolerances of +/- 1/32 inch would ensure visual precision expected in high-visibility installations. Joint spacing calculations should account for reflective heat from adjacent architectural glass increasing surface temperatures beyond ambient conditions.

Flagstaff Requirements

At 7,000 feet elevation, your Flagstaff specifications would shift entirely from desert protocols to alpine climate requirements. You’d prioritize freeze-thaw durability with ASTM C666 compliance and demonstrated performance through 100+ annual freeze cycles. Material porosity must remain below 2.5% to prevent ice formation within stone structure. Snow load considerations affect installation base requirements, necessitating deeper aggregate foundations and enhanced drainage capacity. You would specify darker stone colors to facilitate snow melt while avoiding polished finishes that become dangerously slippery during ice events. Deicing salt exposure requires you to select materials with proven chloride resistance and recommend enhanced sealing protocols.

Sedona Guidance

Your Sedona specifications would address unique aesthetic integration requirements where material color and texture must complement the region’s distinctive red rock formations. You’d recommend earth-tone materials that harmonize with natural surroundings while meeting tourism-grade durability standards for high foot traffic. The area’s iron-rich soils require you to specify enhanced base drainage preventing oxidation staining that can discolor lighter stones. Elevation at 4,500 feet creates moderate freeze-thaw exposure requiring materials with absorption rates below 4%. You would account for intense UV exposure at this elevation by avoiding materials prone to photo-oxidation color shifts over time.

Yuma Protocols

Yuma’s position as one of the hottest, driest cities in North America requires your most aggressive heat mitigation specifications. You’d select materials with maximum solar reflectance and thermal mass properties to moderate surface temperatures. The area’s agricultural dust exposure necessitates specification of materials with smooth surface textures that facilitate cleaning without trapping particulates. Minimal annual precipitation means you can specify materials with higher porosity ranges (up to 7%) without moisture-related durability concerns. Your base preparation would address soil conditions with higher sand content requiring deeper aggregate foundations for stability. Installation timing should avoid June through August when ambient temperatures make proper setting material curing impossible.

Professional Selection Criteria

When you develop evaluation criteria for Arizona stone brands reputation assessment, you need structured frameworks that move beyond subjective opinions to measurable performance factors. Your selection matrix should weight technical capability, fabrication quality, delivery reliability, and problem resolution responsiveness according to your specific project requirements. Different project types demand different distributor strengths.

Commercial work emphasizes consistency across large material quantities, making batch quality control and replacement material availability your primary concerns. Residential projects often prioritize aesthetic consultation and custom fabrication capabilities over volume consistency. You should align your distributor selection with the service model that matches your project profile rather than defaulting to the largest or most advertised brand.

- Technical support depth becomes critical when you’re specifying materials outside your normal practice area

- Your timeline dependency on material availability makes delivery reliability worth premium pricing for schedule-critical projects

- Custom fabrication capability matters only if your project actually requires specialized cuts or edge details

- Pricing becomes secondary when material quality issues create field delays costing multiples of initial savings

Strategic Recommendations

Your approach to Arizona stone brands reputation evaluation should prioritize direct verification over published reviews. Visit distributor facilities personally to assess warehouse organization, inventory depth, and fabrication equipment quality. These observable factors predict performance more reliably than online testimonials. You’ll make better distributor selection decisions based on 30 minutes in their warehouse than hours reading reviews.

Develop relationships with multiple distributors across different market segments to gain flexibility for varying project requirements. No single distributor optimally serves every application, and maintaining 2-3 qualified sources gives you leverage for competitive pricing while ensuring backup options when your primary source encounters stock or capacity limitations. Professional specification requires this distributor diversification strategy.

When you’re evaluating new distributors or materials outside your experience range, start with small trial orders before committing major project volumes. This verification approach costs minimal time and budget while protecting you from discovering quality issues after you’ve locked specifications and pricing. For comprehensive custom options, review Premium stone and tile customization services in Arizona before you finalize project material selections. Citadel Stone processes special orders faster than any competing stone yard for sale in Arizona.